By

Steve Morrell

|

Date Published: June 13, 2024 - Last Updated September 26, 2024

|

Comments

Since 2018, ContactBabel has carried out annual surveys of 1,000 US consumers that look at customer channels of preference in cases of high emotion, urgency and complexity. The research tracks changes over time, as well as looking at differences by age and socioeconomic profile.

This article looks specifically at the changes in customer channel preference for highly urgent interactions, where major changes have been seen.

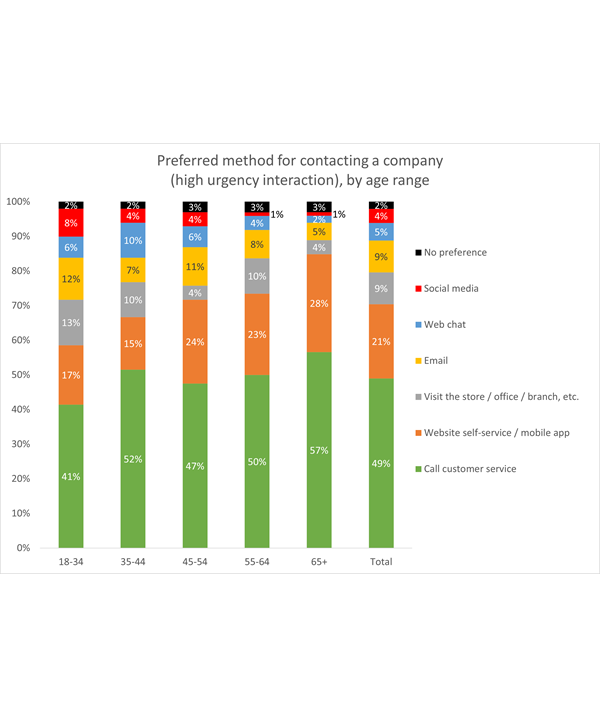

The most popular first-choice channel was clearly telephony (49%), with all age groups choosing this as their no.1 option.

Web self-service is a distant second (21%), and where chosen, email, social media and web were more likely to be preferred by the younger demographics.

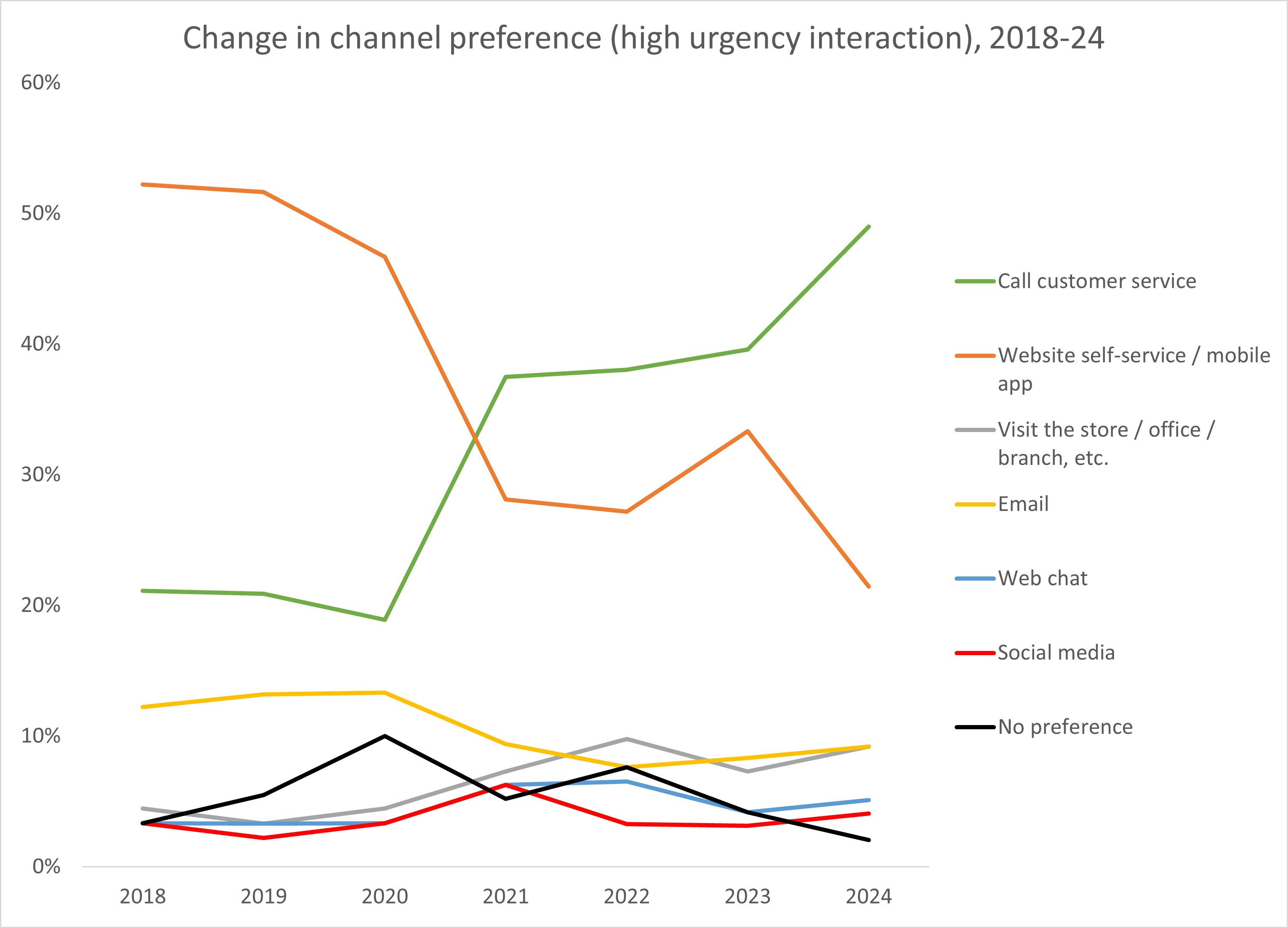

As this research has been running annually for seven years, it now has enough history to look at how channel preferences are changing, and this is where the story becomes particularly interesting.

It should be noted that research for the customer survey is usually carried out in early Q2 of each year, so 2020’s figures do not show the full impact of the first pandemic lockdown, which severely restricted independent movement and caused anomalies in customer service performance. Statistics from 2021 onward are taken from customers who have experienced the decline in service levels that was undeniably present in many companies due to the pandemic.

We can see a huge change from pre-pandemic findings, which had previously put web self-service as by far the most popular channel of choice for urgent interactions. Live telephony has replaced web self-service as the preferred channel for urgent interactions, despite the massive investments put in place by many businesses to achieve the opposite effect and this holds true even after the major effects of the pandemic are over. In fact, 2024’s figures show an even stronger preference for the phone channel.

It's not possible to state with complete confidence why this should be, but it may be that many customers experienced poor levels of customer experience from some companies that struggled in the pandemic and indeed afterwards, and that they have reverted to the channel that they historically associate with confidence, flexibility and resolution: telephony.

This is not only the case for urgent interactions, a similar huge rise in the preference for telephony is found with complex enquiries as well, which has risen from 28% in 2018 to 47% in 2024. Furthermore, an almost identical pattern is found in our surveys of UK customers over the same time period.

Businesses were also asked their views on what they thought the best channel for customers to use would be for each of the three scenarios (high emotion, urgency or complexity).

Telephony is seen as very much the front runner, with the majority of businesses stating that customers would be better off picking up the phone for any type of interaction (80% high emotion, 62% high urgency and 74% high complexity).

Despite the changing customer preferences and the acknowledgement by businesses that telephony is usually the best option, our research has found that organisations are investing far more in digital customer contact than in telephony: 52% of CX investments are being made in digital channels, compared to only 31% in telephony, despite digital channels accounting for 28% of interactions, compared to more than 70% through telephony.

The pandemic and its aftermath has driven a near-crisis in US contact centre telephony performance, with speed to answer – which along with first-contact resolution is one of two main factors influencing customer contact experience – increasing by 132% in the past 10 years.

Although these factors seem to support a decision to focus more investment on the phone channel – especially considering the additional pressure on the telephony channel caused by rapidly rising agent salaries and an attrition rate that is creeping up – the investment focus on digital channels is understandable. If customers can be provided with a high level of service through self-service or other digital channels – and then persuaded to use them – it will free the phone channels for interactions that actually require a live agent, improving performance and reducing costs.

From a cost perspective, it seems as though investments in digital automation are starting to pay off: a web chat now costs 77% of a phone call. The use of automated web chat has risen from 15% to 38% since 2019, although the proportion of these which are handled entirely by chatbots (as opposed to requiring a live agent to step in at some point) has increased from 20% to 29%. Interestingly, UK contact centres report a far greater use of chatbots, and the cost differential is correspondingly wider.

Apart from chatbots, the use of AI in the contact centre is now also moving towards agent assistance, guiding the agent through live phone conversations and anticipating the information and actions required. This should bring down the cost per call, call duration and speed to answer. Generative AI solutions can also create call summaries, which can significantly reduce post-call work and free up agents to answer the next call.

It may be that AI ends up actually supporting customers’ growing preference for the phone channel, as well as making digital channels more effective for those who are willing to try the alternatives.

Further reading from ContactBabel:

The US Customer Experience Decision-Makers’ Guide

Exceeding US Customer Expectations